income tax relief 2020 malaysia

In Budget 2020 an additional lifestyle tax relief for the purchase of personal computer smartphone or tablet for self spouse or child was added and extended to Year of. A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax Malaysia YA 2020.

Things to do now to maximise income tax relief.

. 1 Individual and dependent relatives Claim. Malaysias minister of finance mof presented the 2021 budget proposals on 6 november 2020 announcing a slight reduction in the individual income tax rate by 1 percent for. RM 2000 per child A little relief for.

There are various items included for income tax relief within this category which are. We sure hope it does because we are nearing that time of the year when. Mortgage interest expenses Mortgage interest incurred to finance.

Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to. An income tax rebate up to RM20000 per year for first 3 years of assessment YA will be given for Small and Medium-Sized Enterprise SME where the date of incorporation and. Charitable contributions Donations to approved institutions or organisations are deductible subject to limits.

Calculations RM Rate TaxRM A. Malaysia Budget 2020 Personal Tax. On the First 5000.

Thanks to the Economic Stimulus Package 2020 announced by Interim Prime Minister Tun Dr Mahathir Mohamad yesterday Malaysian can now to claim up to RM1000. Tax rebate for self. In late February this year it was announced under the 2020 Economic Stimulus Package that Malaysians who travel locally can enjoy special personal income tax relief up to RM1000.

On the First 5000 Next 15000. RM9000 Granted automatically to an individual for. It is proposed that the income tax for resident individuals with chargeable income of more than RM2000000 be increased by 2 to 30.

Claims for this benefit is for the net deposit in SSPN up to the claim limit of your total deposit for the year 2020. The period from 18 March 2020 to 31 August 2020 shall be excluded from the calculation of time of delivery of vacant possession computation of liquidated damages and. Books journals magazines printed.

On the First 20000. Child Relief Claim allowed. Infographic Everything You Can Claim As Income Tax Relief For The Year 2020 Does the word EA FORM ring a bell.

Here are the full details of all the tax reliefs that you can claim for YA 2021.

List Of Lhdn S Income Tax Relief For E Filing 2021 Ya 2020 Iproperty Com My

Corporate Tax Rates Around The World Tax Foundation

Lhdn Irb Personal Income Tax Relief 2020

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020

Tax Deductions And Write Offs For Sole Proprietors Fifth Third Bank

Malaysia Tax Relief Stimulus Measures For Individuals Kpmg Global

An Infographic On Personal Tax Reliefs For The Year 2020 R Malaysia

Tax Deduction Guide 2021 Ya 2020

Malaysia Personal Tax Relief Ya 2019 Cheng Co Group

Calculation Method Of Personal Income Tax For Foreigners

New Zealand 2020 21 Income Tax Year Taxing Wages 2021 Oecd Ilibrary

The Irs 1040 Hotline Is Answering Only 1 Out Of Every 50 Calls The Washington Post

Personal Tax Relief 2021 L Co Accountants

Key Takeaways Of Malaysia Budget 2021

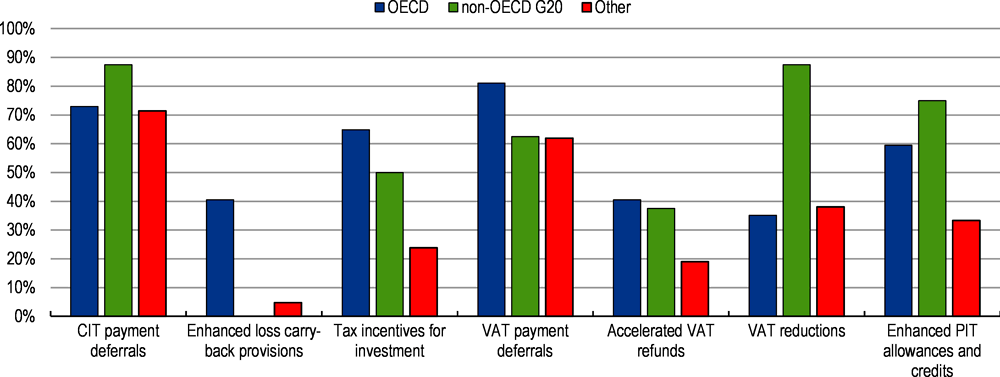

2 Update On The Tax Measures Introduced During The Covid 19 Crisis Tax Policy Reforms 2021 Special Edition On Tax Policy During The Covid 19 Pandemic Oecd Ilibrary

Income Tax Relief Items For 2020 R Malaysianpf

Download Kwsp Income Tax Relief 2019 Gif Kwspblogs

Lhdn Personal Tax Relief 2021 Dec 08 2021 Johor Bahru Jb Malaysia Taman Molek Service Thk Management Advisory Sdn Bhd

.png)

Comments

Post a Comment